Case Study: BNP Paribas Global Markets – From Year‑1 UCL to 2026 Summer Internship (London)

- hassan2990

- Dec 8

- 2 min read

At a Glance

Stage: Global Markets Summer Internship (London, 2026)

Timeline: ≈1 recruitment cycle (joined in Year 1)

Inputs: Skool community + masterclasses + targeted feedback

Frameworks: VTMR™, PEAL‑3™, PEAL‑X™, STAR‑3™, BDC™

Before

Early‑stage UCL student with strong intent but generic answers, “I’ll do it later” drift, and CV lines reading as student activity rather than operator‑level impact.

After

Selection‑grade assets built around focus and value‑add statements, weekly accountability and feedback in Skool, culminating in a BNP Paribas Global Markets 2026 Summer Internship offer.

Problem

Most first‑years in Global Markets fall into the same trap: good intentions, scattered effort and treating applications as something to “get around to”. Vivek arrived at the start of Year 1 with ambition but risked that failure mode. His CV showed activity not outcomes; answers leaned on “passion for markets” rather than decisions; and there was no weekly execution rhythm. Without structure, accountability and a clear standard, even strong candidates underperform. The challenge was to turn raw potential into operator‑level signalling: every line earning its place, motivation reading as inevitable not hopeful, and a weekly system that forced progress instead of last‑minute panic.

Solution

Rebuilt CV with VTMR™ → 100% bullets with metrics and decisions → shifted signal from “student” to junior operator.

Structured application answers with PEAL‑3™ → 4‑part logic in each response → evidence‑first motivation across forms.

Crafted PEAL‑X™ “Why BNP GM” → fact‑per‑sentence discipline (public context only) → firm‑fit perceived as specific, not generic.

Engineered master stories with STAR‑3™ + BDC™ → pressure, judgement, teamwork, ownership framed with results → interview‑ready in 60–90s.

Enforced “every line must earn its place” + Skool accountability → weekly outputs posted and iterated → drift ↓; consistency ↑.

Result

BNP Paribas confirmed Vivek’s offer for the 2026 Global Markets Summer Internship Programme (London). The offer reflected community structure, consistent posting in Skool, and standards applied line‑by‑line across CV and applications. VTMR™ made every bullet carry measurable impact; PEAL‑3™ and PEAL‑X™ produced commercially aware, firm‑specific answers; STAR‑3™ and BDC™ delivered interview‑ready stories. Consistency—not last‑minute effort—did the heavy lifting.

ROI

Metric | Result |

Investment | Skool community membership + weekly effort (fee not disclosed) |

Summer internship comp (est.) | Market‑ and year‑dependent (not disclosed) |

Pay‑back period | Short‑term brand & skills uplift; faster if converted to FT offer |

Lifetime uplift | Pathway into front‑office Global Markets; long‑run six‑figure potential (illustrative) |

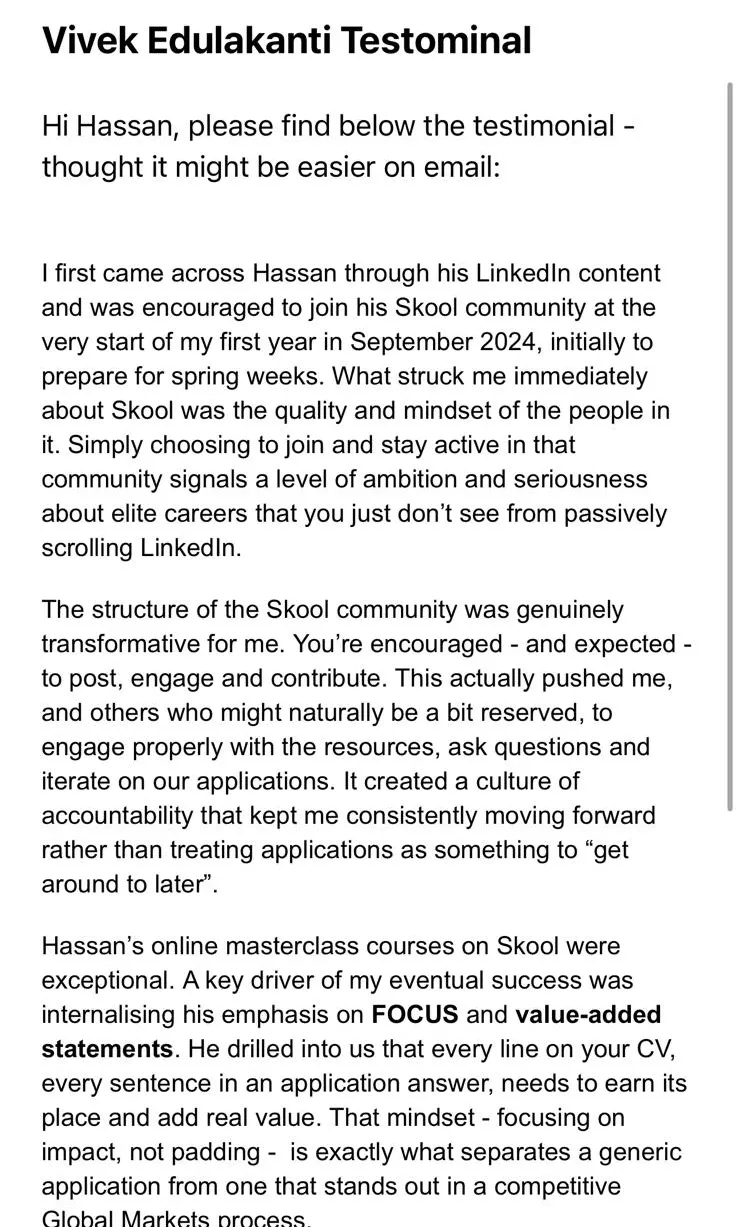

Testimonial: “The structure of the Skool community was genuinely transformative for me… It created a culture of accountability that kept me consistently moving forward rather than treating applications as something to ‘get around to later’.” — Vivek, UCL undergraduate.

We work with just 30 clients globally per year across all programmes, with just 5 in the flagship programme.

Comments