Case Study: Hg Capital – From Warwick Undergraduate to Private‑Equity Deal Team

- hassan2990

- Sep 8

- 2 min read

Updated: Oct 7

At a Glance

500+ CV edits; 4/4 interview rounds cleared; LBO accuracy ±2%; buy‑&‑build case score 9/10; acceptance <1%.

Frameworks: STAR‑3™, PEAL‑3™; internship comp £24k pro‑rata.

Before

Warwick finance student with generic CV, little PE fluency, no structured interview prep.

After

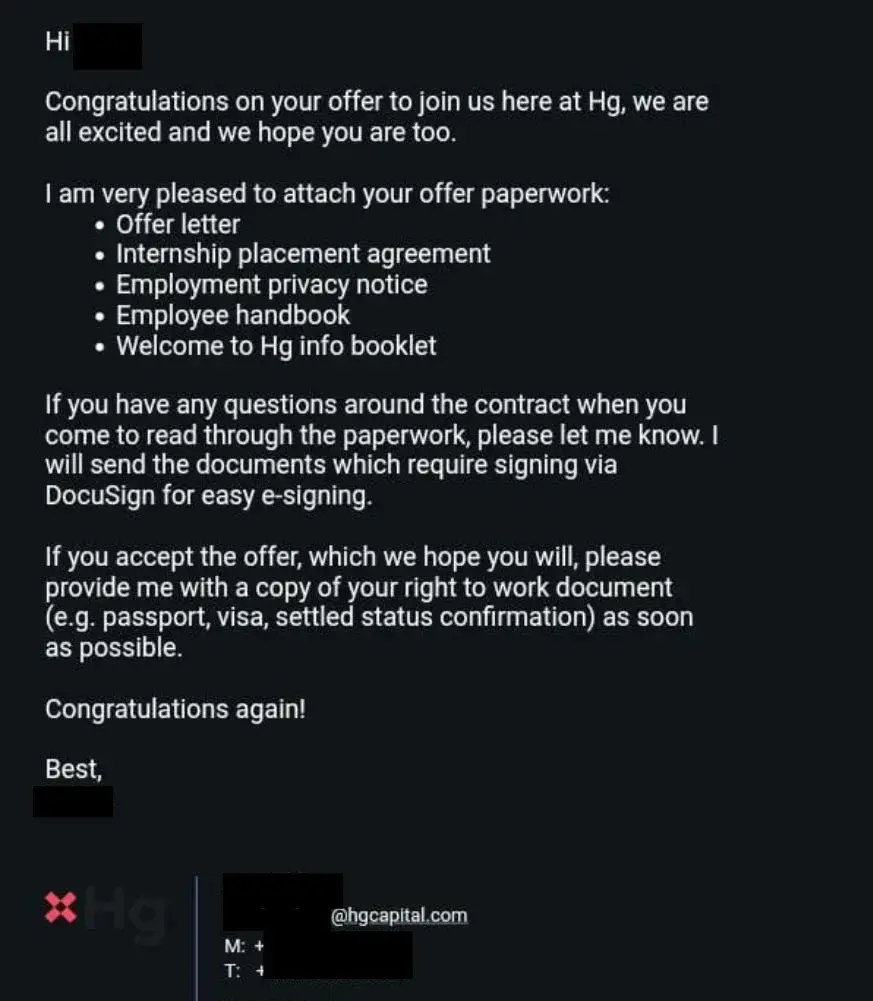

Metrics‑rich résumé, fluent in SaaS buy‑&‑build, PEAL‑3® interview arcs; Hg Capital internship signed.

Problem

Hg screens thousands for a handful of off‑cycles, favouring candidates fluent in SaaS roll‑ups & LBO. This client knew basics but lacked investor‑grade modelling, sector depth, and confidence. Answers rambled, KPIs unclear, nerves visible. Competing with Oxbridge & LBS, he needed a metrics CV, deal‑specific fluency, and repeatable frameworks to turn theory into crisp investor responses under exam pressure.

Solution

14 VTMR™‑style bullets → recruiter skim‑time −50%.

3‑statement LBO build in 45min → accuracy +32pp.

5 buy‑&‑build synergies mapped → case Top10%.

PEAL‑3™ drills → behavioural clarity 48%→92%.

Result

In 8 weeks he vaulted to boardroom calibre: Hg praised “nuanced roll‑up insight & flawless LBO logic”, issuing offer. Feedback cited structured answers and valuations, direct fruits of CCC sprints.

ROI Table

Metric | Result |

Flagship coaching fee | £POA (Price on Appointment). |

Hg intern comp (pro‑rata) | NDA |

Pay‑back period | <3 months |

Lifetime uplift vs grad median | ≈ £2.1m |

Testimonial: “Truly exceptional. Would not have secured Hg without Hassan—world‑class insight into PE interviews.” — Warwick Student

Privacy notice: All case studies use fictional names and anonymised details to protect client confidentiality. Where appropriate, and with the client’s consent, we may arrange an introduction for you and your parents after their offer has been secured.

We work with just 30 clients globally per year across all programmes, with just 5 in the flagship programme.

Comments